Lower Chickahominy

Lower Chickahominy Economic Studies

2019 Economic Study Findings

As part of the data gathering and analysis process, a team from George Mason University's Center for Regional Analysis and Urban Analytics, Inc. conducted an economic study of the three counties in the Lower Chickahominy area. The study sought to answer two key questions about the role of natural resource conservation in the study area localities.

Do conservation easements negatively impact a locality's fiscal bottom line?

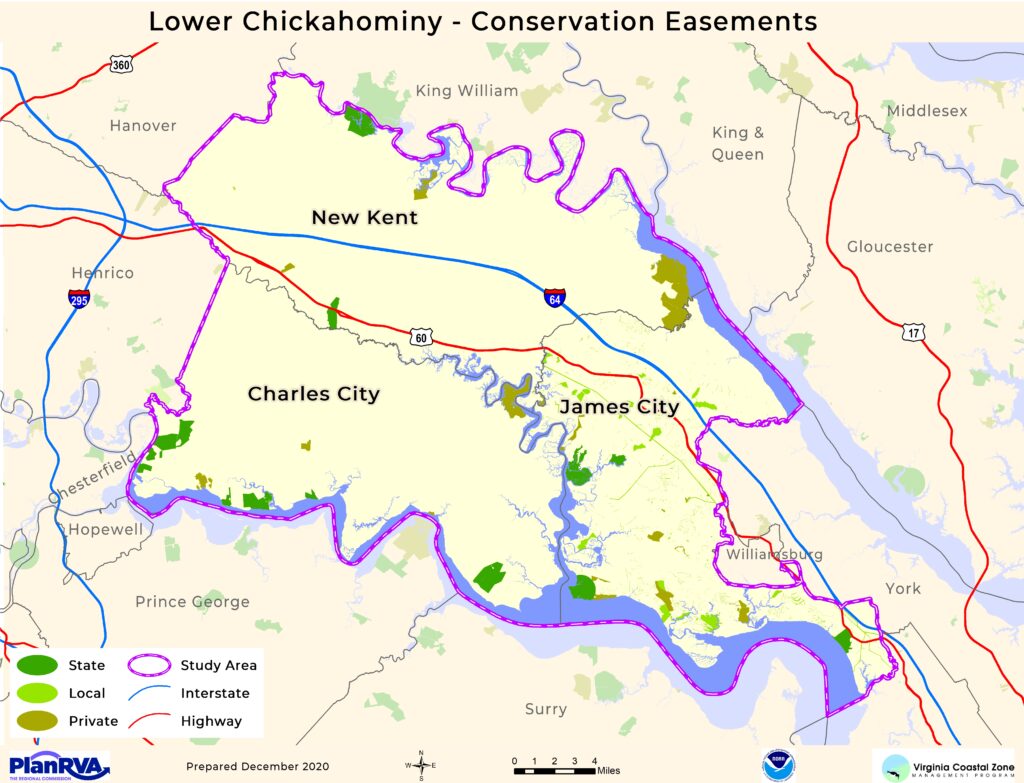

Answer - No, conservation easements do not negatively impact a locality's bottom line. In fact, for every dollar spent on services to land with conservation easements, revenue to each county in the study area is estimated to be greater. This revenue generation holds true even when factoring in a reduced tax rate on land conserved with conservation easements due to the use-value taxation policy in Virginia. The Study's authors indicated that this expenditure - revenue relationship is projected to hold true in future years and that additional conserved land in each county should not invert the relationship either.

Lands Under Conservation Easement

Jurisdiction Expenditure Revenues to County

Charles City County $1.00 $1.28

James City County $1.00 $1.53

New Kent County $1.00 $1.21

Do conserved natural lands contribute to the area's economy?

Answer - Yes, businesses and organizations that are directly reliant on conserved lands contribute to the area's economy and local tax revenues. Directly affected businesses are those that indicate “but for the presence” of conserved lands and their impacts on the environment, their businesses would not exist. These businesses include seasonal eco-tourism operations, marinas, restaurants, campgrounds, and retailers who specifically cater to outdoor enthusiasts. Relevant local government park operations are considered directly affected business too; the jobs they provide and wages they pay are part of the area's economy.

Organizations directly related to land conservation in the Lower Chickahominy study area supported about 100 direct jobs in 2018. The economic activity related to this direct employment generated almost $8.4 million in regional economic output, boosted area value added by almost $4.4 million, and supported a total of 118 jobs paying $2.5 million in salaries, wages, and benefits. Local governments received an estimated $368,000 in revenues associated with this economic activity.

Economic Impact of Direct Organization Spending (2018)

Description Impact

Output (economic activity) $8,369,000

Gross Regional Product (value-added) $4,376,000

Labor Income (salaries, wages, benefits) $2,486,000

Jobs (headcount) 118

Local Tax Revenues $368,000

You can download the full Economic Study here:

SOCIO-ECONOMIC IMPACTS OF CONSERVED LAND IN THE LOWER CHICKAHOMINY RIVER WATERSHED

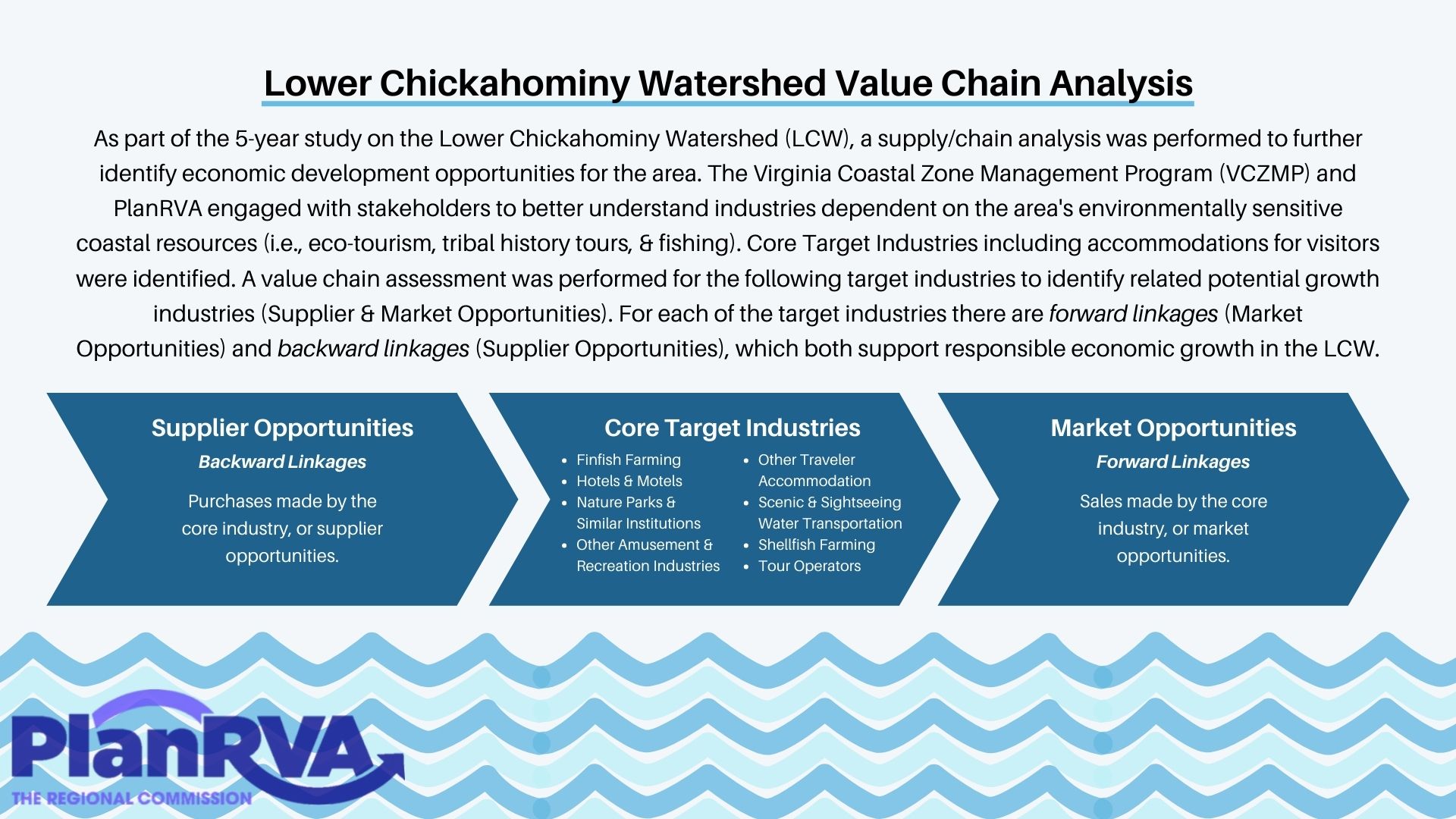

2020 Target Industry and Value Chain Analysis Report

The Center for Regional Analysis at George Mason University recently completed this report looking at environmentally sensitive target industries for the Lower Chickahominy watershed and the value chains that support them.

Target Industry and Value Chain Analysis Report

Scroll down to read more about it.

What is a conservation easement?

A conservation easement is a legal agreement between a landowner and a land trust or government agency that permanently protects specific conservation values by limiting the future development of the land. Land under a conservation easement is still held by the owner and can be used actively according to the terms of the easement, for example, as open space, for recreation, for agriculture, or for forestry. Each conservation easement is unique.

What is use-value taxation of conservation easements?

In Virginia land under a conservation easement is assessed for taxation purposes at the use-value for open space. As stated in the Code of Virginia, the use-value is the “reduction in the fair market value of the land that results from the inability of the owner of the to use such property for uses terminated by the easement." In other words, land under a conservation easement is taxed a lower rate than non-eased land due to the inability of the owner to develop the property.

This project, Task # 93.01 was funded by the Virginia Coastal Zone Management Program led by the Virginia Department of Environmental Quality through Grant FY18 #NA18NOS4190152 of the US Department of Commerce, National Oceanic, and Atmospheric Administration, under the Coastal Zone Management Act of 1972, as amended. The views expressed herein are those of the authors and do not necessarily reflect the views of the US Department of Commerce, NOAA, or any of its sub-agencies.